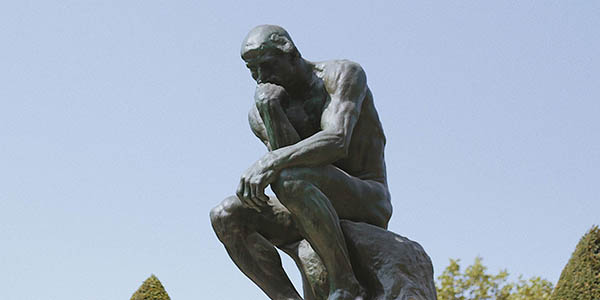

What Were the Founders of Stock Exchanges Thinking?

Stock exchanges exist to raise capital for companies by allowing the public to “share” in ownership through buying and selling – also known as trading.

Think of the bourse (the exchange) as your local market. You invest twenty percent of your earned money in that store for a share of the equity. The store owner reinvests with your money, into the purchase of a new store. For every dollar of profit he earns, you receive twenty cents since you own a twenty percent share in his company, (now a chain of stores because of your investment). That makes sense to most, at least on a local level. But why were stock exchanges invented? What was the original intention of the founders? Have you ever wondered?

Globally, the stock exchange has existed much longer than in the United States. But if we simply trace it back to the first exchange in America, that would be in Philadelphia, established as the Philadelphia Stock Exchange in 1790. However in 1792, 24 founding members signed the Buttonwood Agreement, which is the founding document of the New York Stock Exchange, which has become arguably, the most dominant exchange in the world. Before the Buttonwood Agreement, there was no real regulating body for trading. This meant many loans went unpaid and trade deals were not honored and there was no recourse. All this chaos resulted in a crash and mass panic.

People were making lots of money on debt trades but refusing to pay back the investors. The founders of NYSE and the signers of the Buttonwood Agreement established regulations and a central governing body out of necessity and need to establish rules for trade and to calm the fear of the people. The impetus for the creation of a different way, began with one William Duer. A market speculator, he hedged the money that he borrowed, but refused to pay any of his debts. Bad actors like Duer, shook market confidence when loan repayment could not be guaranteed. That meant people were not trusting their money in the market. Unlike the stock exchanges as we know them to operate today, the first NYSE, as per the Buttonwood agreement, was a kind of exclusive financial club. Brokers and bankers lent each other money as part of a members only fraternity. The club was a guarantor. If a member chose to secure a loan outside of the club, other signees would have priority on the money. It was a very early, quid pro quo style of trading, but members were none-the-less bound by the regulations.